Residential property development can be very profitable, however equally costly if not approached with vigilance.

Taking the first step

Residential property development can be very profitable, however equally costly if not approached with vigilance. In this blog series over the coming weeks, we reveal our 15 key lessons that are the result of experiences in the recent past. These lessons have been learned the hard way, sharing our experiences so you don’t have to make these same mistakes. Hard work, determination and the sqft.capital deal modelling tool coupled with these rules to live by will lead to that long and profitable property development career you dreamt of.

Property Development Deal Modelling – showing investors and lenders that you have planned your deal thoroughly

It is not possible to know what you are going to get wrong on a deal. Until you do. However, there are some basics to understand that will help (and shock) you enormously about how to build a proper financial model that will be taken seriously by lenders and investors. The vital point here is when modelling a deal, you show all possible costs and not the ones that might not arise or you would prefer to avoid (like VAT – you can't do things for “cash”). As soon as you start doing this, it may feel like an elephant on your shoulders as so many “deals” suddenly don't work at. Grasp hold of the following and you are on your way to being a qualified developer. Avoid the following and you will get burned, badly.

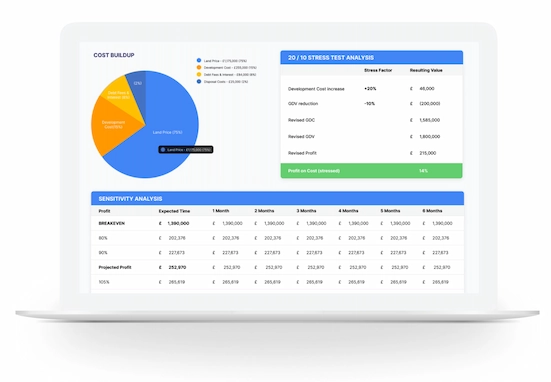

A general rule of thumb for any developer starting out is 20%. You should be aiming - with all developments - to be returning 20% profit on cost - this is the total profit (after all costs, including sales / disposal costs) divided by the total cost, shown as a percentage. Variations of this can be considered in different economical climates and timescales – which will be explored later. For now, 20% is the magic target POC.

E.g. How to show a good return:

- Acquisition costs = £700,000.

- Development costs = £90,000.

- Finance costs = £35,000.

- Disposal costs = £30,000

- Total costs = £855,000.

- Gross development value = £1,030,000.

- Profit = £175,000.

- P.O.C. = 20.5% (assuming one year duration).

The sqft.capital deal modelling tool is the fastest way to fully analyse a deal, however to show this profit on cost we need to break down and understand four elements of costing (and later, the time accrued for the deployment of the investment). These are as follows:

Acquisition costs - all costs associated with buying the property and up to the first draw down of the development loan. Just to revisit debt loans - these come in two parts that are the land loan (purchase) and the development loan (build). This reason for this is that a debt lender has the most secure position so as to be protected as much as possible for the exposure being any loss of return. As such, their return is typically the lowest but the most guaranteed and the first to be paid out. Therefore, debt lenders will always pay 100% of development costs and then a percentage of the acquisition costs with the balance creating the equity requirement you need to put in. Acquisition costs will include the purchase price of the asset, SDLT, surveys, planning fees, party wall awards, bank due diligence fees, professionals such as architects and structural engineers and legal fees. As a result, the equity portion will pay for all fees up front as no debt lender will take any risk on costs should the development not move to fruition - this is a risk that cannot be mitigated and so must be clearly shown as equity risk.

Development costs - these are all of the costs associated with the build out of the asset. They can include the actual contractors costs, VAT (which can be at a variable rate depending on the type of work / property) further professional fees (such as building inspectors, bank due diligence, quantity surveyors) and any finishing or professional dressing fees.

Finance costs - this is the total cost of your debt. This is made up generally of the APR multiplied by the total loan, multiplied by the number of months (or part thereof) that it has been deployed for. There are some significant extra factors to be taken into consideration however when calculating total finance costs, such as;

- Land loans will be made from the day of completion of purchase and be for the duration of the project until the completion of sale. As such, this figure is very easy to project but can only actually be calculated at the end of the project (as it can never be known exactly on what date the sale will take place). As such, it is very important to show some contingency in terms of time - sales can fall through, delays in construction can happen - and they will!

- Fees; all banks will usually charge an “in” and “out” fee - this will be fixed for the “in” fee as the total loan at the start (land loan) is known and will not be easily changed. As for the “out" fee, it can sometimes not be required but if it is, it will either be a percentage (1 to 2) of the total loan (in which case it can easily be calculated) or as a percentage of the GDV, in which case it can be projected but not finalised until the sale is complete And the sale price known.

- The development loan is based on the lender's quantity surveyors report or confirmation that your projected costs for works are correct. It can only be drawn down in tranches in arrears of works completed. Therefore, contractors must know that they can only be paid for works that are done. A valuation will take place whenever you need and will involve the bank’s Q.S. coming to site (for a fee) to check that the works invoices for have actually been done - as such, ensure that your contractor has all correct invoices in place if they want to be paid quickly. Any incorrect information will only cause delays in the release of funds.

- Disposal costs - these are all costs associated with the disposal of the asset(s) and should be limited to estate agents costs (try to pre-agree a fee for sale at an early stage of the development) and solicitors fees for the sale. While the estate agents costs could be quite significant, legal costs should be minimal. Don’t forget VAT (for the avoidance of doubt, VAT cannot be reclaimed on property developments, even if owned by companies / SPVs)).

Once all of these costs are broken down, you should now have a firm view on the overall cost of the deal or GDC. These costs will always seem far too much, but don’t be tempted to try and cut corners at this stage as it will catch up with you. There are not many reliefs available to the property developer but one that may be of use to you is that of VAT savings on certain developments. This is always worth exploring through the HMRC website which is fairly thorough. At a certain stage, it is definitely recommended to have an accountant on board who has a tax and construction specialisation – they will more than pay for themselves and may help you out of bother.

So the stages of money going in are as follows (on the hypothetical deal at the beginning of the chapter):

- Equity – due diligence fees, planning fees, surveys, purchase deposit of 10%, legals, banks due diligence (legals, professional costs), planning drawings, license for alterations, party wall awards etc. Then the balance of the purchase price (the total projected GDC less the agreed bank loan – which is typically 50-80% of GDC).

- Bank land loan – the balance of the purchase price of the asset.

- Development drawdowns – tranches of money from the bank to pay bills for works done on site.

- Over and above – any costs not allow for will have to be met by equity to MAKE SURE YOU HAVE A CONTINGENCY IN PLACE!!

Want to hear more?

Sign up to hear useful information on leading market rates and lenders deals.